Gallium: The Constraint Metal Powering the AI Revolution + Paid Subscriber Weekly (#44)

This past week was choppy; false starts, fast reversals, plenty of noise. Even so, momentum across the complex still favors the sectors where policy and physics continue to do the heavy lifting.

This week’s deep dive goes to gallium - a small, opaque market with outsize consequences. If vanadium is the “rules metal,” gallium is the constraint metal: scarce, policy-sensitive, and increasingly non-optional for the power backbone of AI, EV fast-charge, and next-gen electronics. The market doesn’t trade on a screen, and prices rarely tell the full story. The edge here is knowing how this system clears, what really drives it, and where tightness shows up first.

What makes gallium stand out

By-product reality.

Gallium isn’t mined directly. It’s mostly recovered as a by-product from aluminum and zinc refining, occasionally alongside REEs. That structure makes supply largely price-insensitive in the short term and policy-exposed in the long term. Output doesn’t ramp when prices rise; it follows refinery throughput and government regulation.

Wide-bandgap pull.

In the power stages of AI data centers, silicon is quietly losing ground to GaN (gallium nitride) and SiC (silicon carbide). These materials switch faster, generate less heat, and handle higher voltages - crucial for energy-dense systems like GPUs and fast-charging EV platforms. At hyperscale, a 1–2% efficiency gain compounds into megawatts saved. That’s why gallium isn’t a fad; it’s an engineering inevitability.

Thin, opaque pricing.

There’s no futures curve, no exchange, and almost no liquidity. Contracts clear through purity-based assessments (4N–6N) and bilateral deals. This means the screen won’t show you what’s happening; adoption curves and customs forms will.

Supply concentration; and why it matters

China still dominates primary production. The rest of the world relies on secondary sources, co-recovery experiments, and recycling. That concentration makes gallium both a risk and an opportunity. Small disruptions, export-control tweaks, or restarts can move the entire curve overnight.

Because the absolute market size is so small, even 10–20 tonnes per year of new supply can reset sentiment. That asymmetry is the point: policy beats price, and the headlines will always lag the data.

The 2025 setup - where the tape can flip

Architecture standardization.

Hyperscalers are formalizing 800 V DC backbones and 97–98% PSU efficiencies. Every iteration locks in more GaN per rack; demand that never hits the commodity feeds.Ex-China co-recovery.

Any verified gallium recovery from bauxite, zinc, or REE streams in the West gets outsized attention. The tonnage barely moves the needle, but the narrative does.Policy cadence.

Licensing changes, tariffs, and strategic-minerals designations all reshape availability. This market trades on paperwork, not price ticks.

How to track it

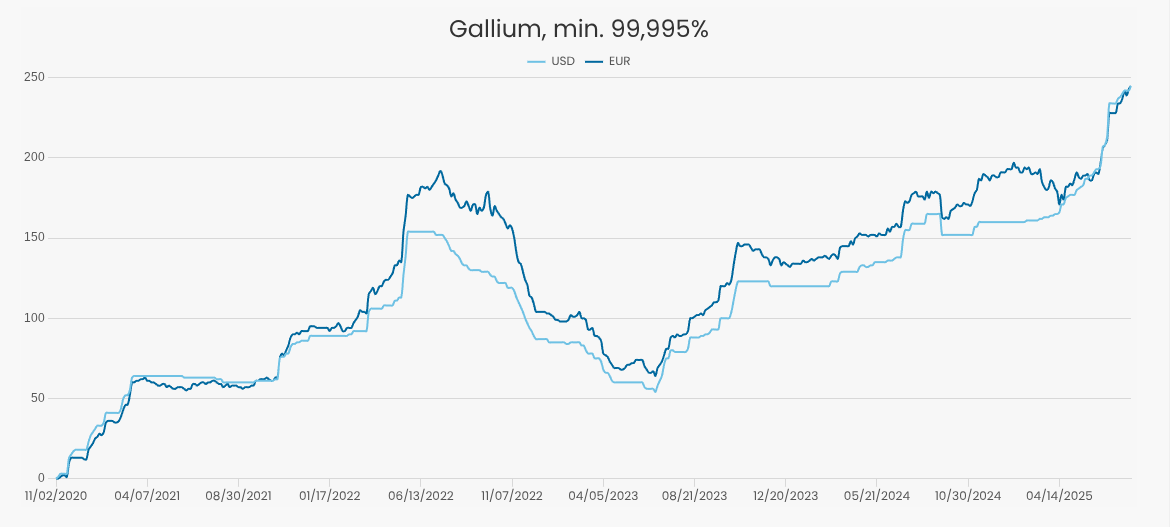

For once, there is a chart worth watching but not for trading. The gallium price (min. 99.995%) has quietly more than doubled since early 2023, climbing from roughly $100/kg to over $240/kg by October 2025. That’s not speculation; it’s the reflection of tightening supply meeting structural demand, in a market where discovery happens off-screen.

Unlike exchange-traded metals, gallium trades through purity-based assessments and bilateral contracts, so every move you see is already lagging reality. Still, the trend tells a story: the multi-year compression that began after the 2022 spike has resolved upward, signaling that policy friction and technology pull are finally intersecting.

To stay ahead of the curve, track the lead indicators, not the lagging price:

Device adoption: confirmed GaN PSU rollouts, ORv3 reference builds, and hyperscaler design wins.

Lead times: any extension in GaN component deliveries hints at bottlenecks upstream.

Policy cadence: export controls, subsidies, and new critical-mineral funding programs in North America or Europe.

The price chart below shows what happens when a niche metal stops being optional. Two years of quiet compression just broke into an accelerated climb, and that’s what early repricing looks like

How to Play It

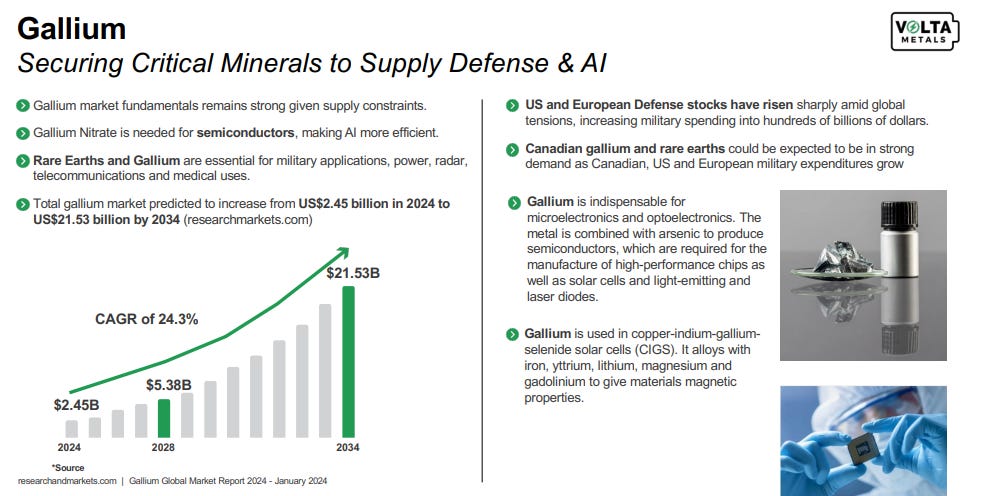

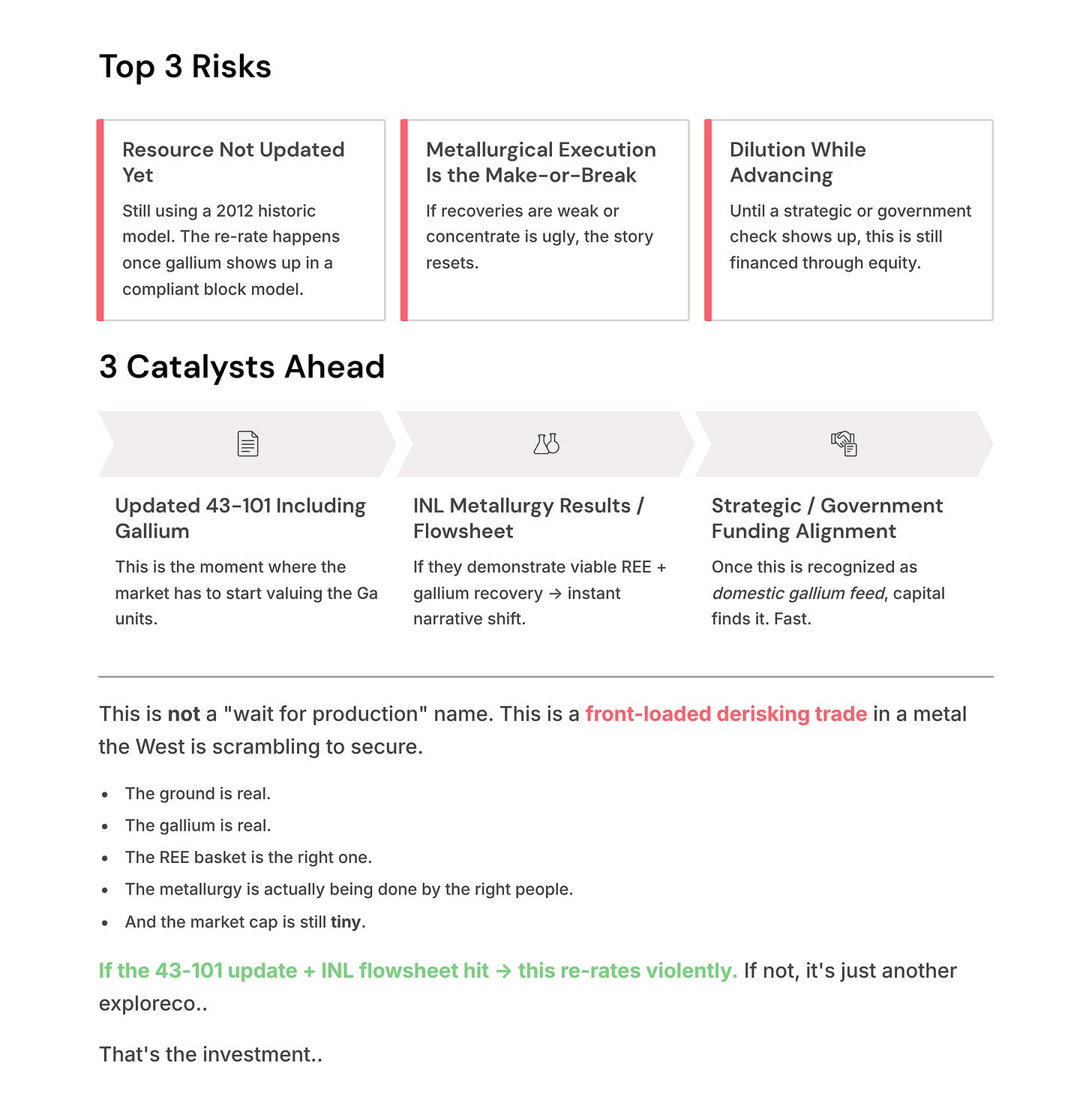

We’ve got a handful of gallium names on the radar right now, but one stands out above the rest. Volta Metals (VLTA) sits at the center of what the West is trying to build; a domestic REE + gallium supply chain in a Tier-1 jurisdiction. The market cap remains microscopic (~C$20M), yet the setup already checks the right boxes: real ground, real metallurgy, and a system that’s actually being advanced by the right people. As you can see from the current share price, it’s still early - the move off the lows barely scratches the surface of what this could become if catalysts line up. What I shared early this week with paying members:

The trade here isn’t about waiting for production; it’s about de-risking in front of the curve.

Bottom Line

Gallium is the quiet constraint powering the AI build-out, and this chart says it all. With China controlling nearly 99% of global gallium supply, the West is effectively flying blind into a structural bottleneck. Policy, physics, and scarcity are now converging at the same point; and that’s where multi-year trends begin.

We have several gallium names on our radar, but VLTA remains the No. 1 pick for now - positioned squarely in a Tier-1 jurisdiction, advancing real metallurgy, and unlocking a supply line the market still isn’t pricing.

If you want the full list, entry bands, and catalyst ladder for the remaining gallium plays, they’ll be unlocked as a paid subscriber.